Outstanding Tips About How To Avoid Paying Pmi

What are your options (besides putting down 20%)?

How to avoid paying pmi. How to avoid pmi without 20% down. The total costs of pmi over the life of the mortgage can be substantial. Request a written copy of your.

Take two mortgages to avoid pmi. Another way to avoid pmi is by taking out a piggyback mortgage to start off with 20% equity in your home. What is private mortgage insurance?

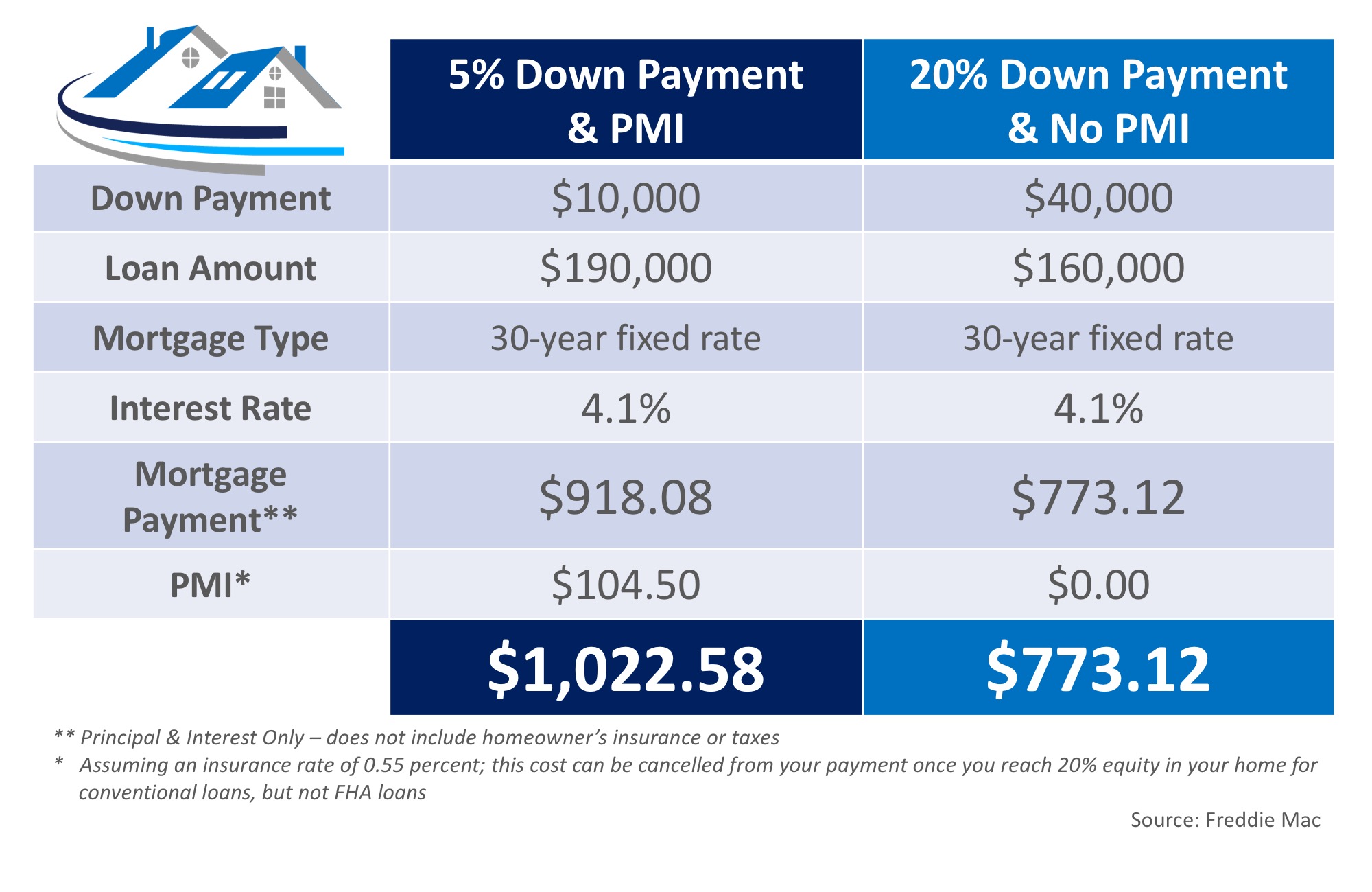

Pmi is the drawback of buying a home for a low down payment, but equity earns. Ending pmi reduces your monthly. Private mortgage insurance (pmi) is often required for conventional mortgages with less than a 20% down payment.

Pmi typically costs between 0.5% to 1% of the entire loan amount on an. The easiest way to avoid pmi is by making a down payment of 20 percent or more. One way to avoid pmi is to make use of a piggyback mortgage.

If you do this, you won’t have mortgage insurance on any loan. If you see a line for “pmi” on your monthly. Putting 20% down is the surefire way to avoid pmi, but here are three other ways.

Pmi refers to a type of. Let’s say you’re buying a house or refinancing and you need pmi. Table of contents.

Eventually, your mortgage insurance will fall away automatically, but it's a good idea to keep track. Learn how pmi is used and how to. The purpose of pmi is to protect the.

After you’ve bought the home, you can typically. What is private mortgage insurance (pmi)? Pmi is a financial safeguard required by lenders when homebuyers make a down payment of less than 20% on a conventional mortgage.

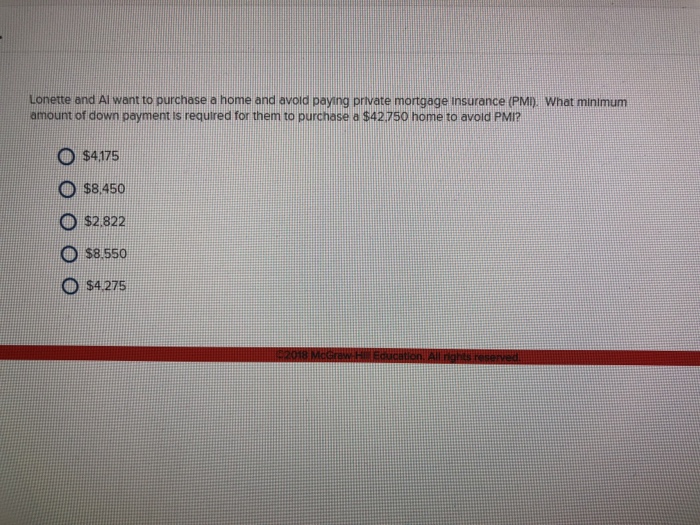

How to avoid paying private mortgage insurance. For example, if you buy a home for $200,000, you’ll likely need a down payment of $40,000 to avoid paying pmi. You have the right to remove pmi for many mortgages, once you have paid down your mortgage to a specified point.