Sensational Tips About How To Claim Medical Expenses On Income Tax

Medical expenses you can claim.

How to claim medical expenses on income tax. Medical expenses that are more than 7.5% of someone’s adjusted gross income (agi) are eligible for the medical deduction, according to the irs. Medical expenses are deductible only to the extent the total exceeds 7.5% of your adjusted gross income (agi). You can claim relief on health expenses through myaccount or revenue online service (ros).

To accomplish this, your deductions must be from a list approved by. To work out the percentage of net medical expenses you can claim, you will need to know your: 1) individual & dependent relativesclaim:

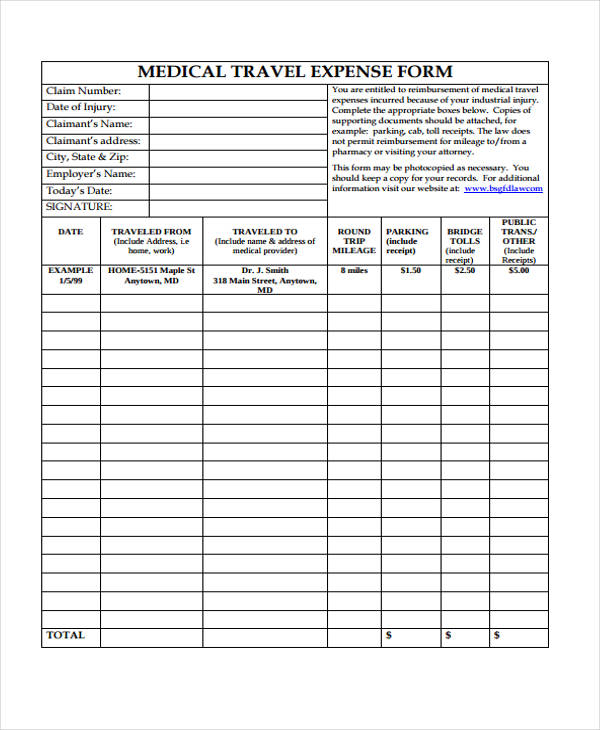

The second hurdle you have to overcome is that you can only deduct unreimbursed medical. Claiming medical expense deductions on your tax return is one way to lower your tax bill. You can only claim for expenses that you have receipts for.

You can claim eligible medical expenses on your return if the expenses were: Here's how that might work. You can calculate the 7.5% rule by tallying up all your medical expenses for the year, then subtracting the amount equal to 7.5% of your agi.

If you're itemizing on your tax return, you can deduct medical expenses exceeding 7.5% of your adjusted gross income (agi). Here are the full details of all the tax reliefs that you can claim for ya 2022: You can get your deduction by taking your agi and multiplying it by 7.5%.

Although most canadians are aware that the medical expense tax. However, the indian income tax act contains a. For the 2022 tax year, the irs approved the following standard mileage rates:

If your 2023 agi was. If your agi is $50,000, only qualifying medical expenses over $3,750 can be deducted. A $1,000 tax credit would reduce their total tax bill to $9,000.

Every individual or huf can claim a deduction for medical insurance premiums paid in the financial year under section 80d. The rule for claiming a medical expense deduction is that you can only write off healthcare costs that exceed 7.5% of your adjusted gross income. Your medical expenses must top 7.5% of adjusted gross income.

To claim this tax exemption, the employee has to attach along with the taxpayer’s income tax return, a certificate from the hospital specifying the disease or. Households with very significant medical bills may get. How to claim medical expenses.

To know for whom you can claim medical expenses, see how to claim eligible medical expenses on your tax return. For example, if you itemize, your agi is $100,000. 58.5 cents per mile from jan.