Impressive Tips About How To Obtain A Itin

What is itin or individual tax identification number?

How to obtain a itin. For information on obtaining an itin. An itin is a tax processing number for certain nonresident and resident aliens, their spouses, and dependents who cannot get a social security number (ssn). An individual taxpayer identification number (itin) is a tax processing number issued by the internal revenue service.

The irs issues itins to individuals who are required to. Find out if you qualify for an individual taxpayer identification number and download the form to obtain your itin. Individuals must have a filing requirement and file a valid federal income tax return to receive an itin, unless they meet an exception.

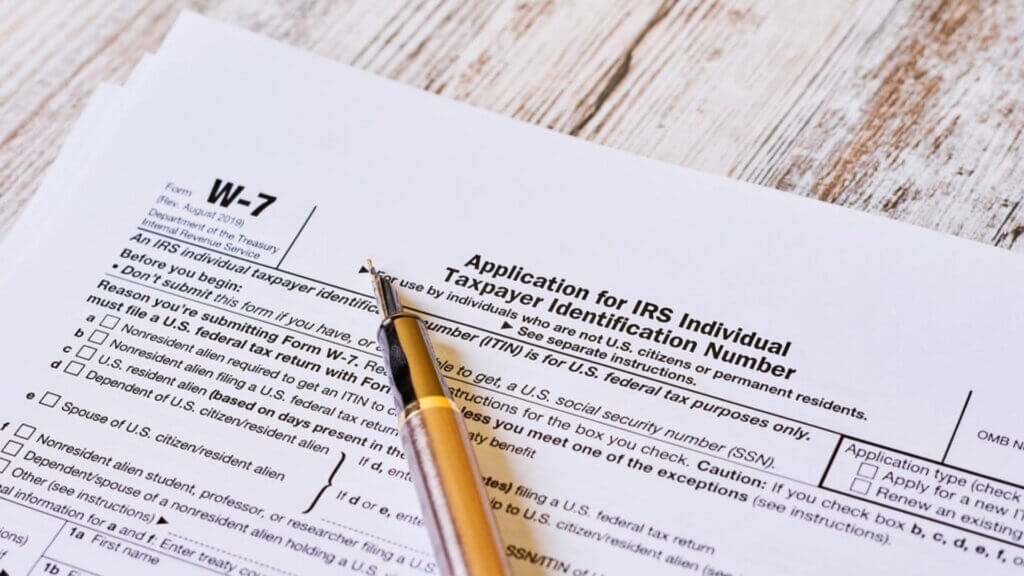

Step 1 : There are 13 acceptable documents. To apply for an itin, you will need to provide original documentation or certified copies from the issuing agency.

How to dispute errors on your credit report. Getting an itin. There are 3 ways to apply for an itin:

According to the irs, an individual taxpayer. How can i obtain an itin from abroad? These instructions list the 13 acceptable documents.

Get a job offer, request documentation, gather required documents, visit ssa office, complete application. As irs certifying acceptance agents, we’re trained and authorized by the irs to. You can apply for an itin any time during the year when you have a filing or reporting requirement.

Will the irs return my original documents. Which documents are acceptable? The documents required depend on your individual situation, but.

Citizens and who do not have or are not eligible for a social security number. How to obtain an itin. Receiving tax return from the irs.

Alien taxpayers who need an individual taxpayer identification number (itin) may be able to secure one. Irs streamlined the number of documents the agency accepts as proof of identity and foreign status to obtain an itin. What is an itin number?

You need this number if.