Simple Info About How To Write Financial Hardship Letter

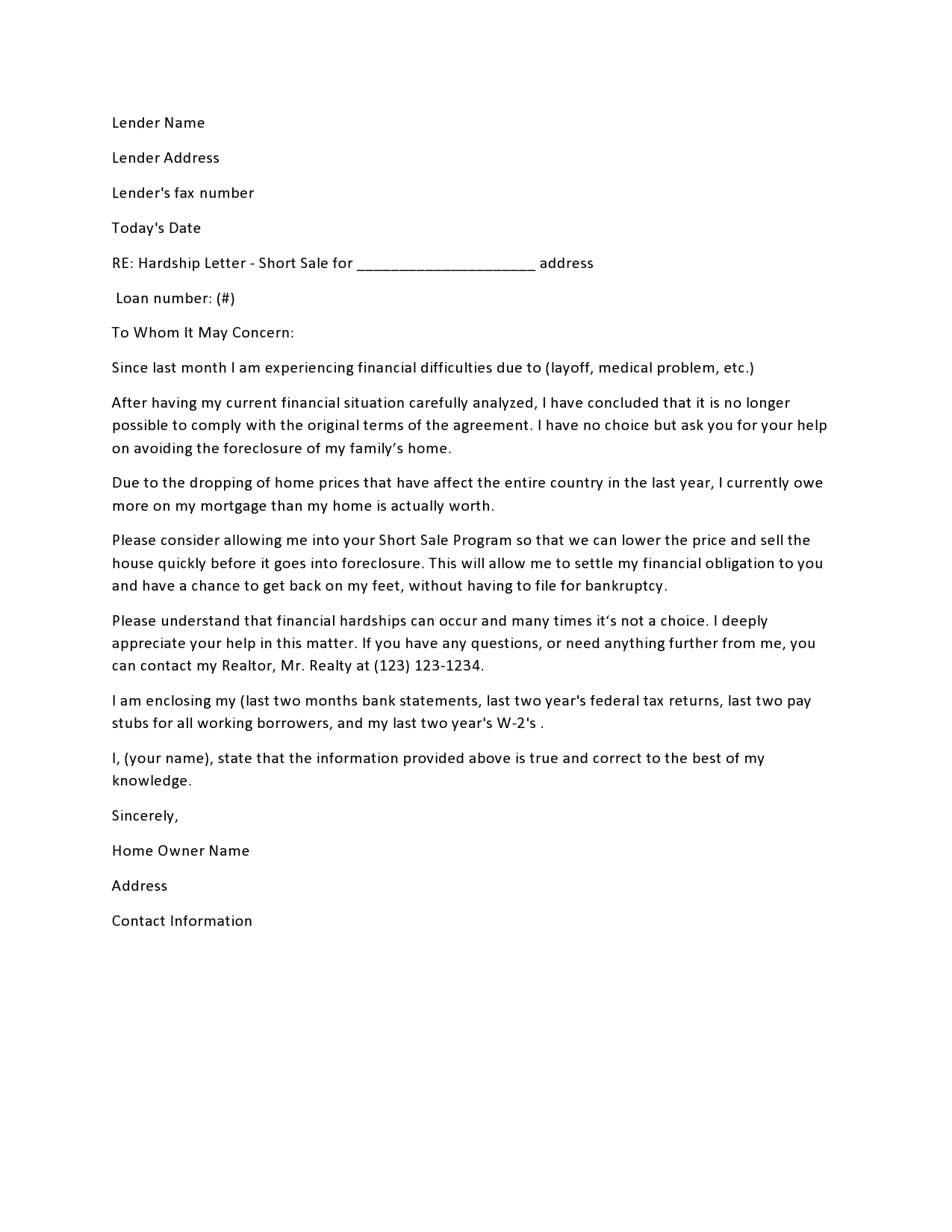

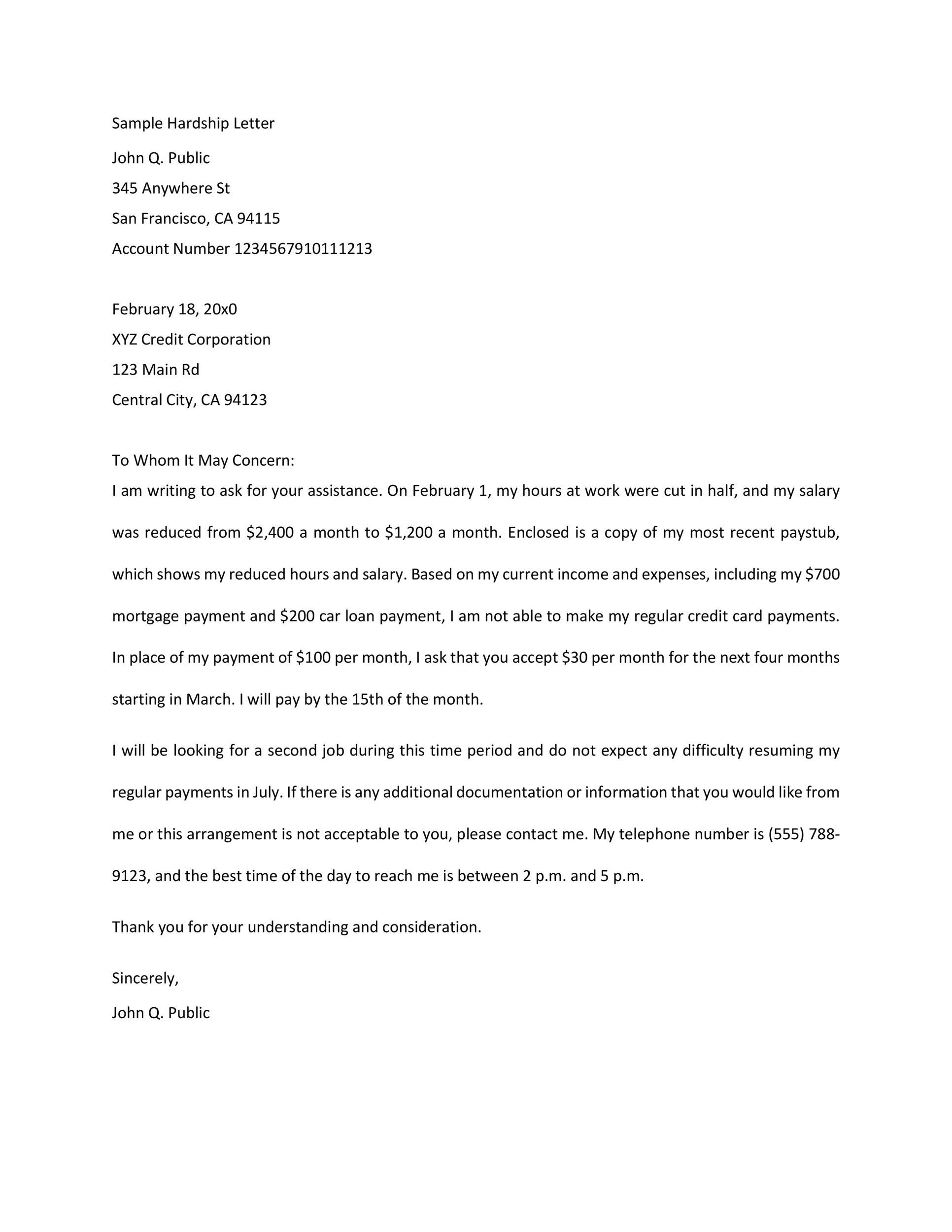

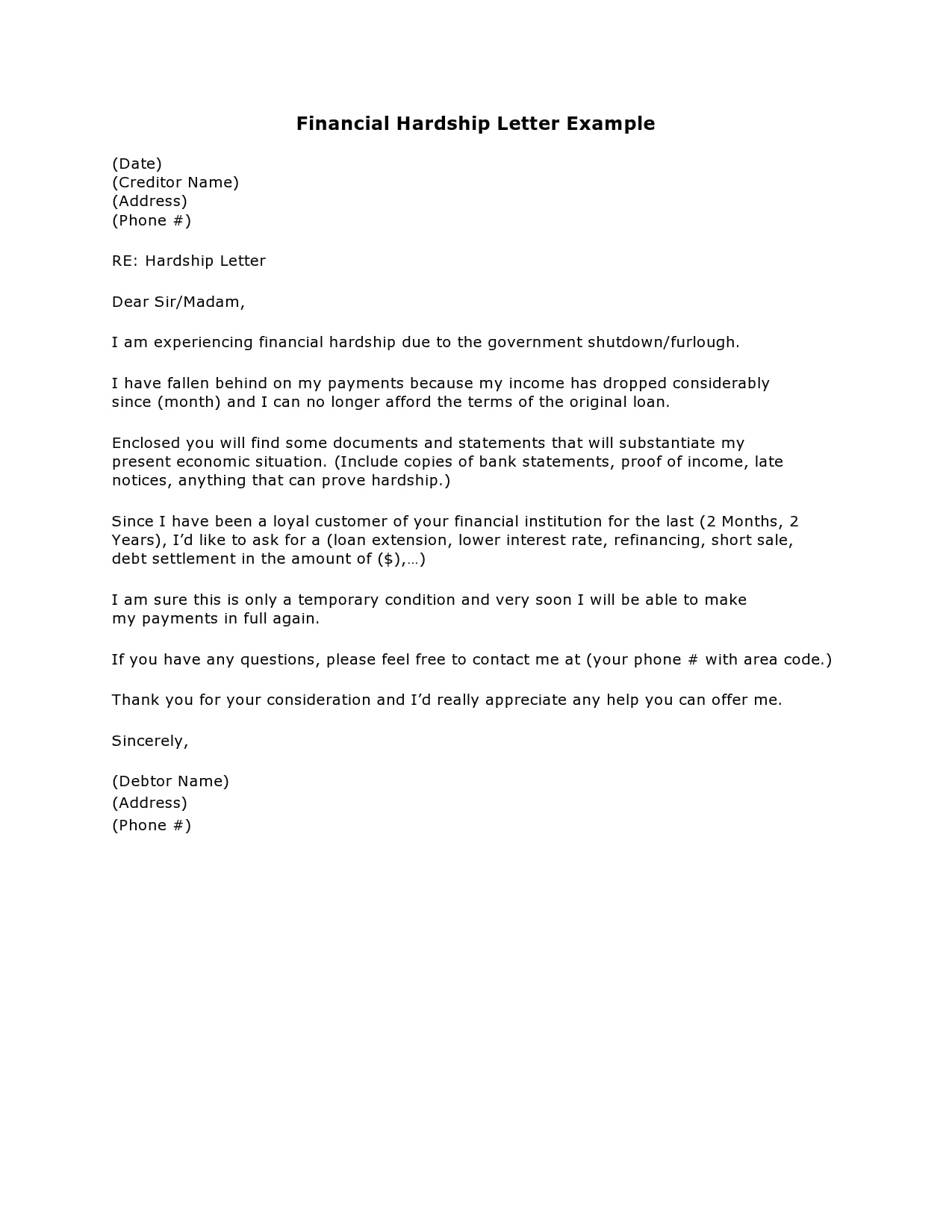

Settling the debt (perhaps proposing lower amount that will be paid in one sum) short.

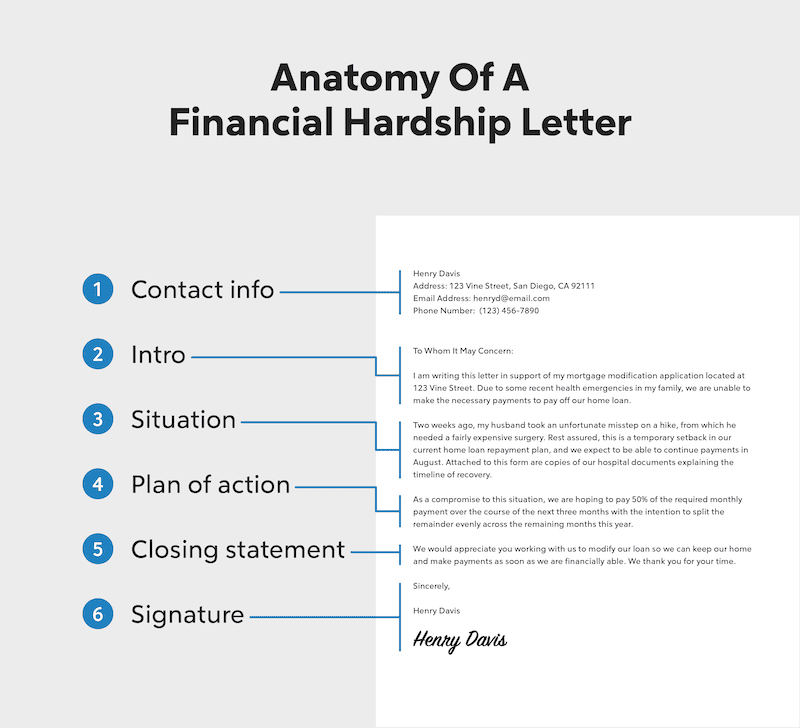

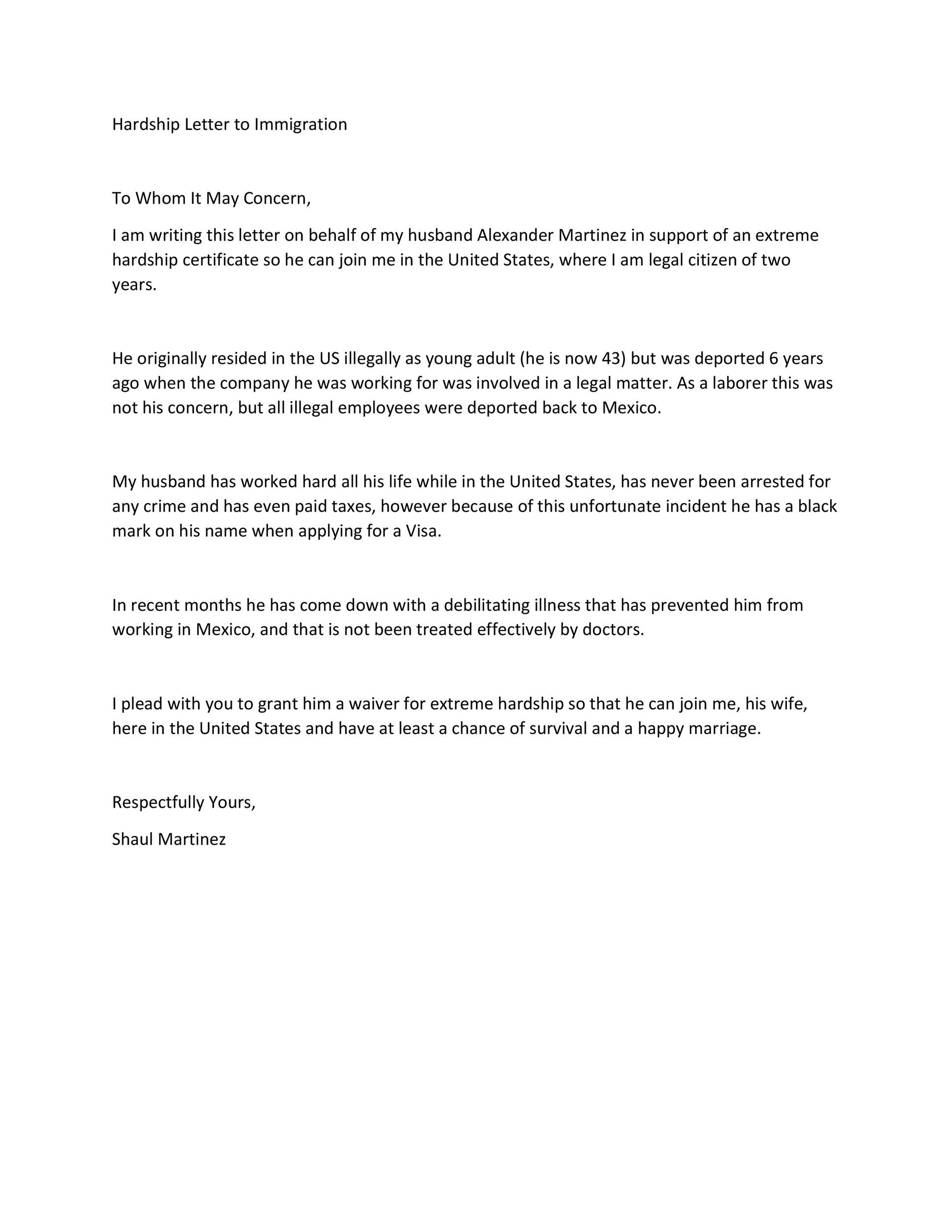

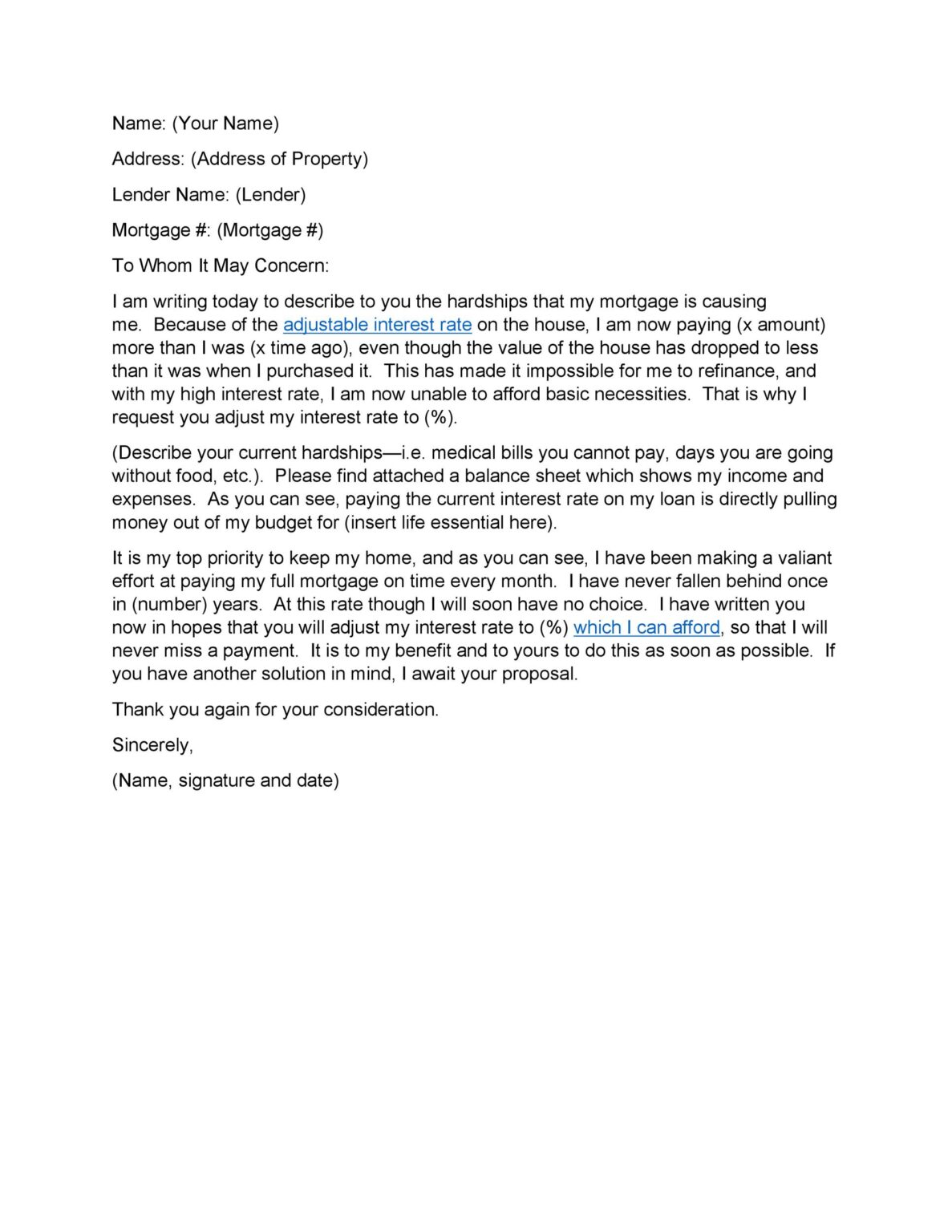

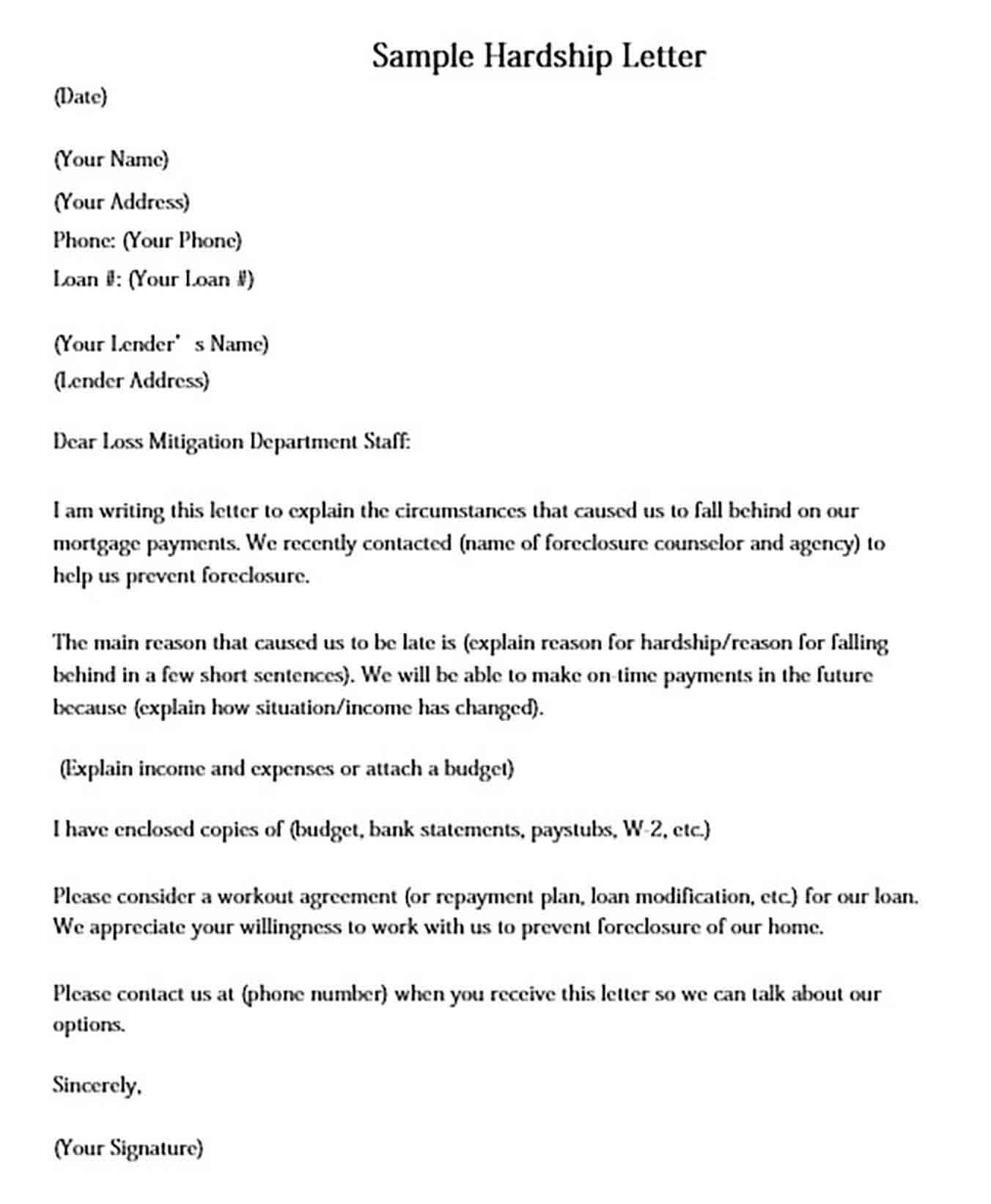

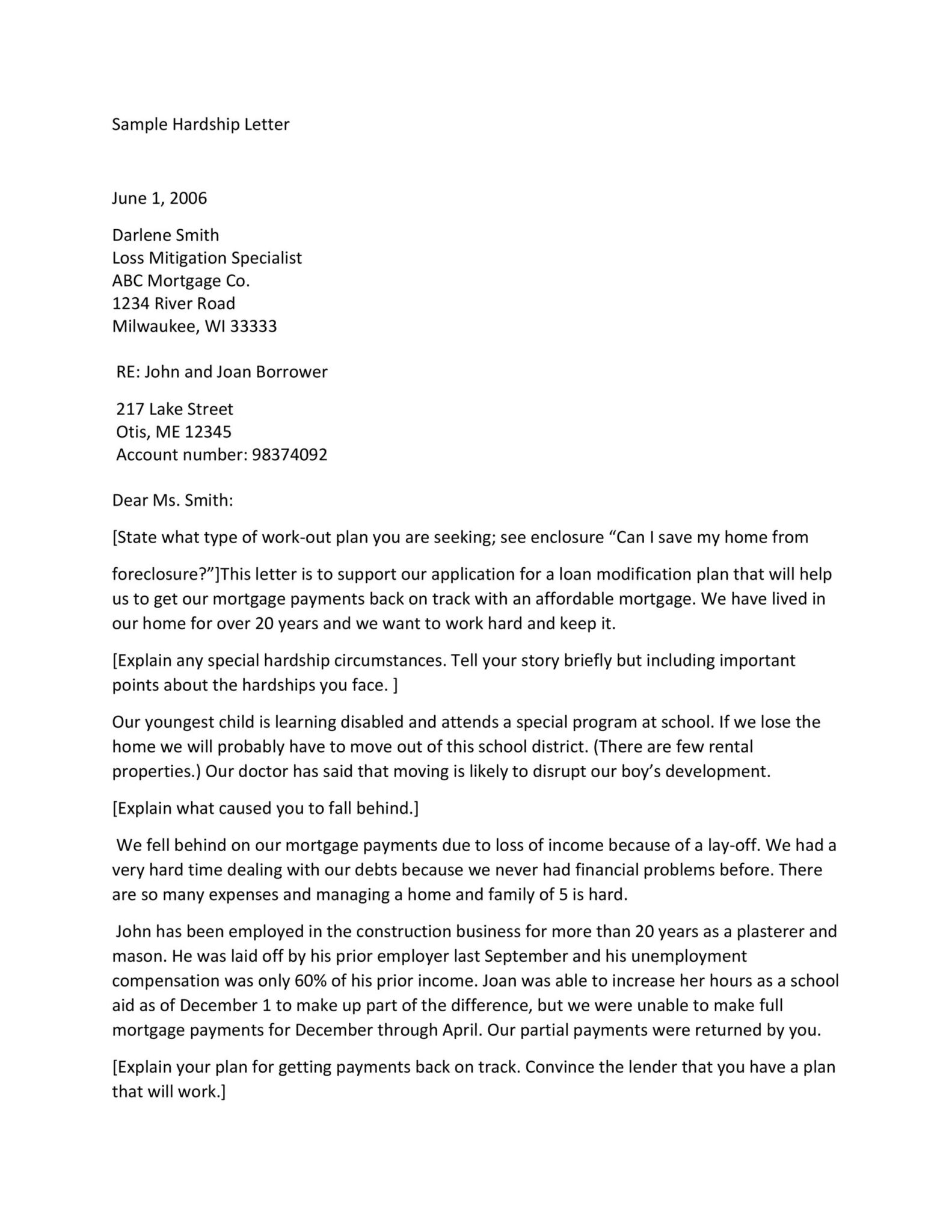

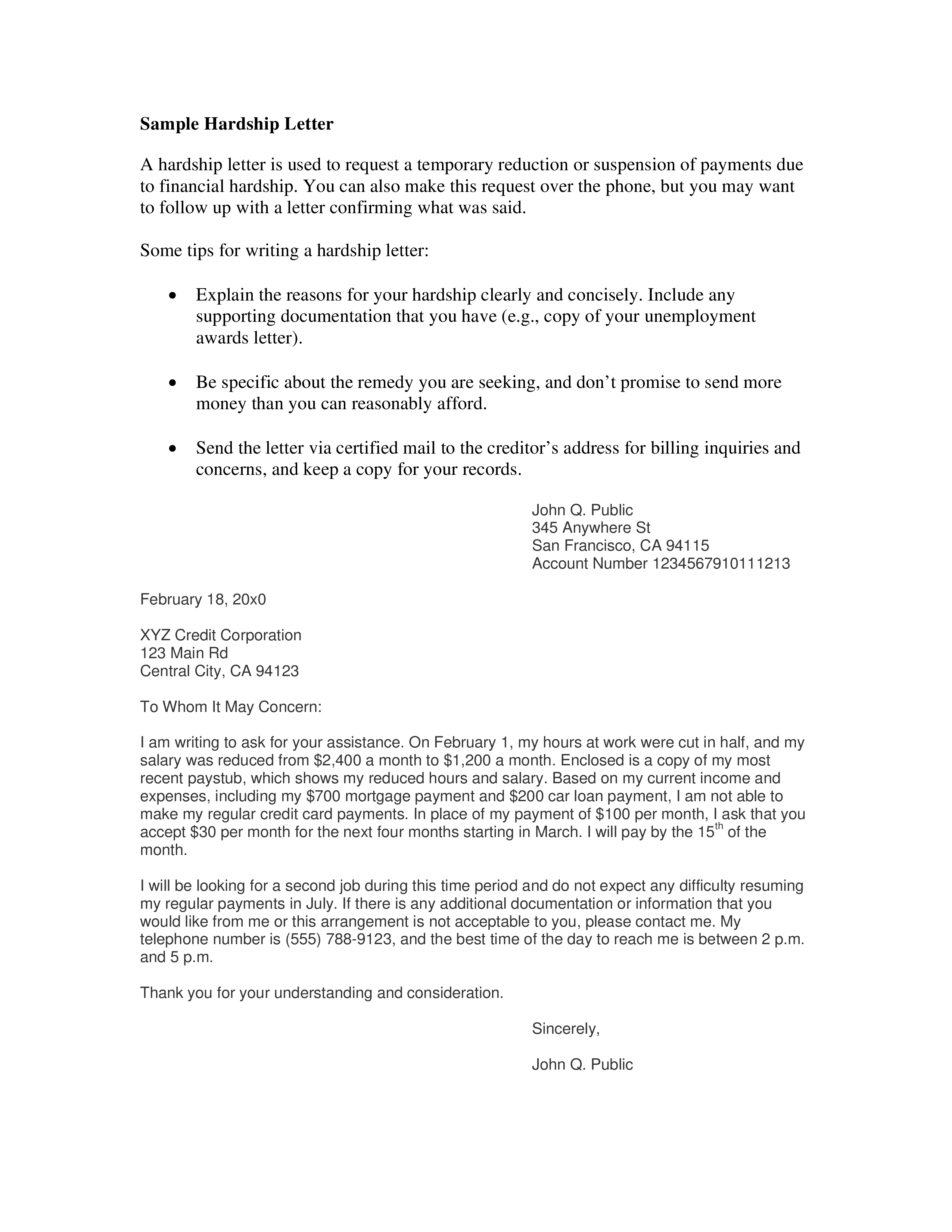

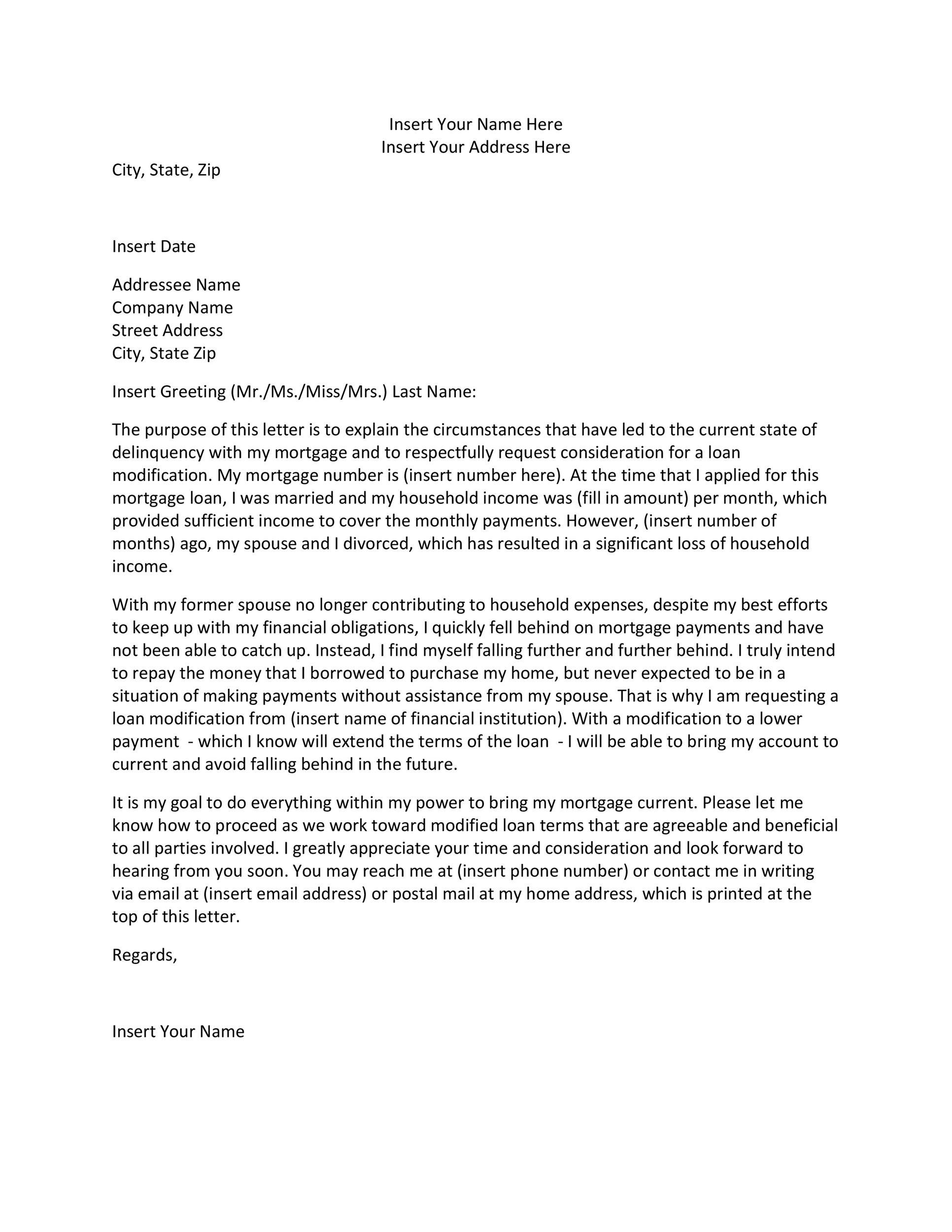

How to write financial hardship letter. Circumstances that warrant a hardship letter. Introduce yourself and explain your financial hardship. Last week, the department of education released proposed regulatory text to cancel student debt for borrowers who are experiencing hardship paying back their.

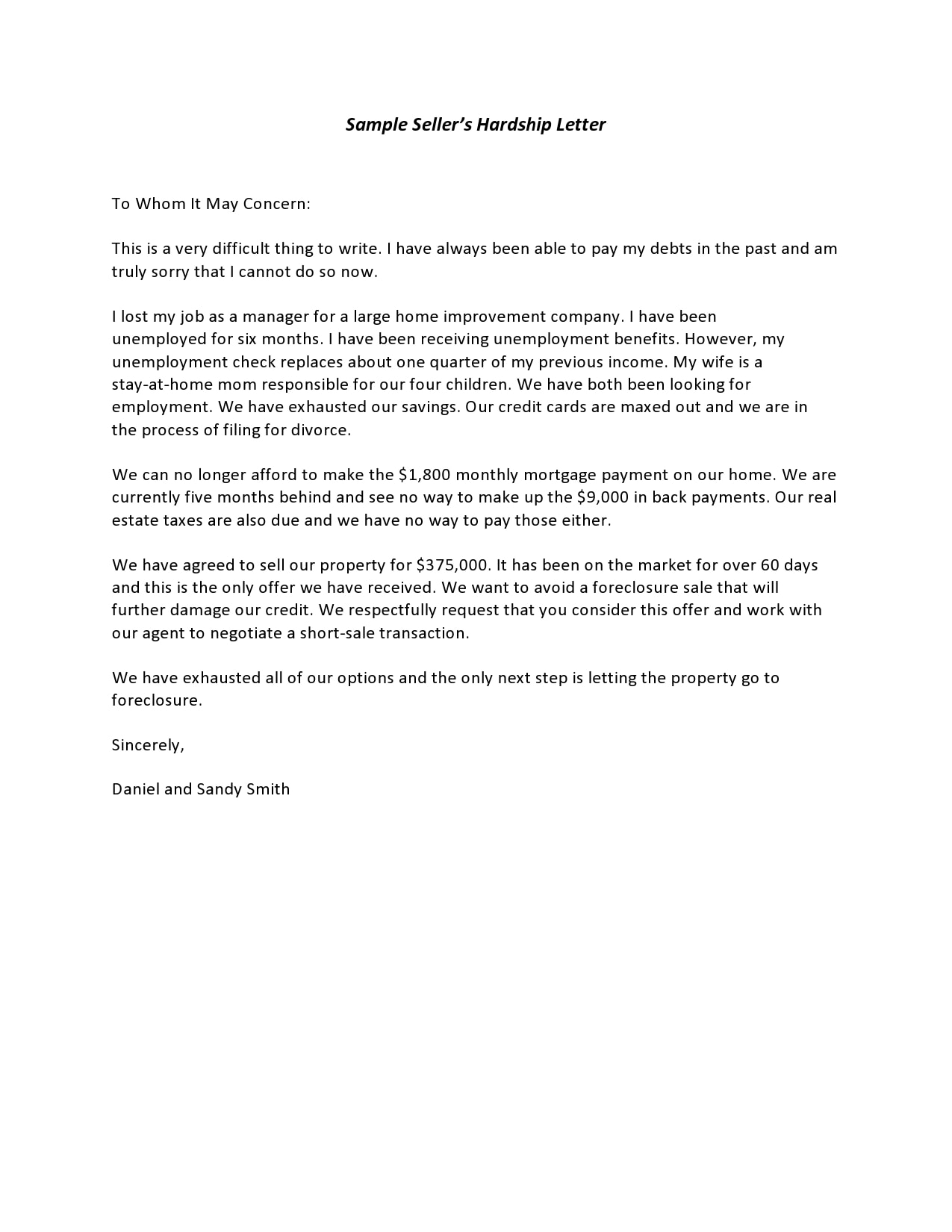

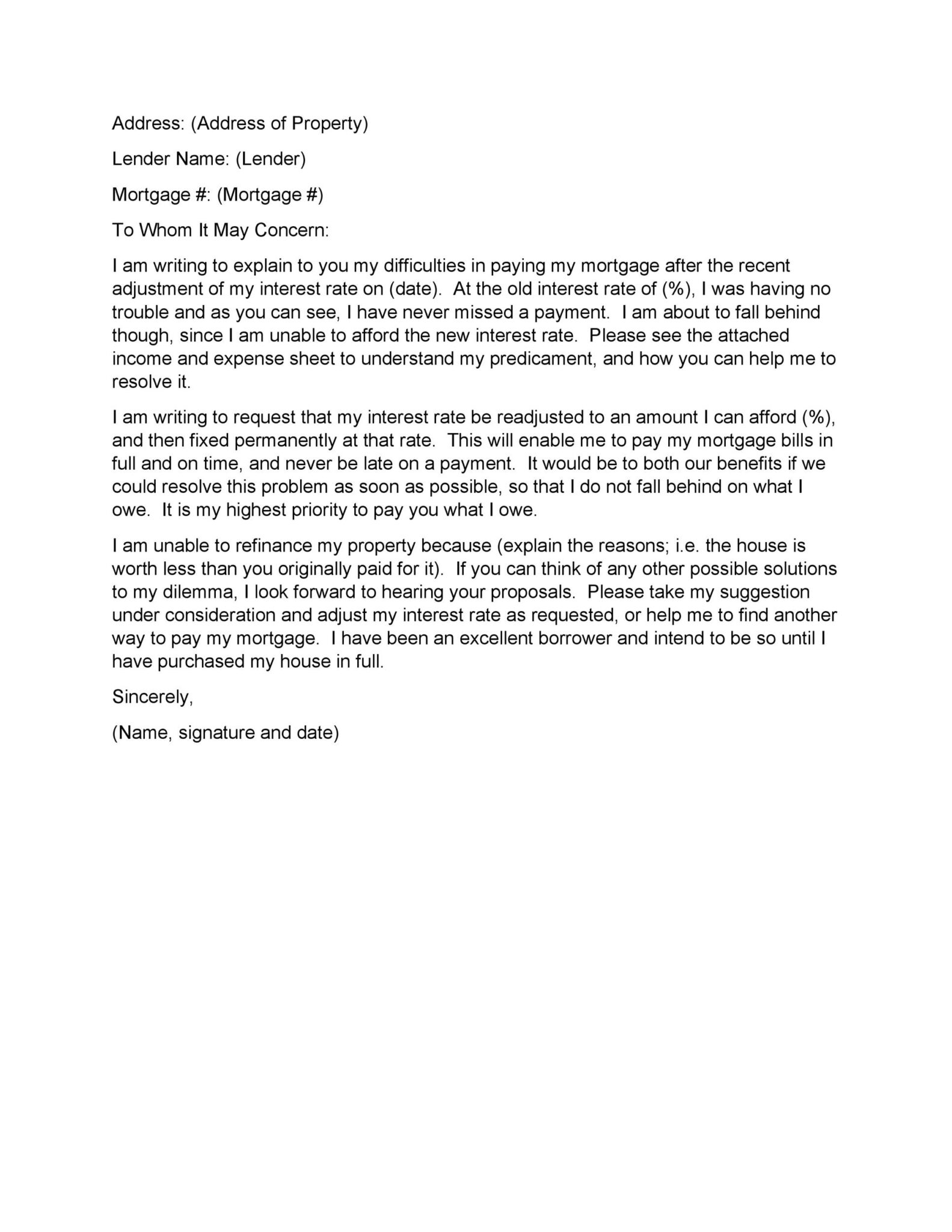

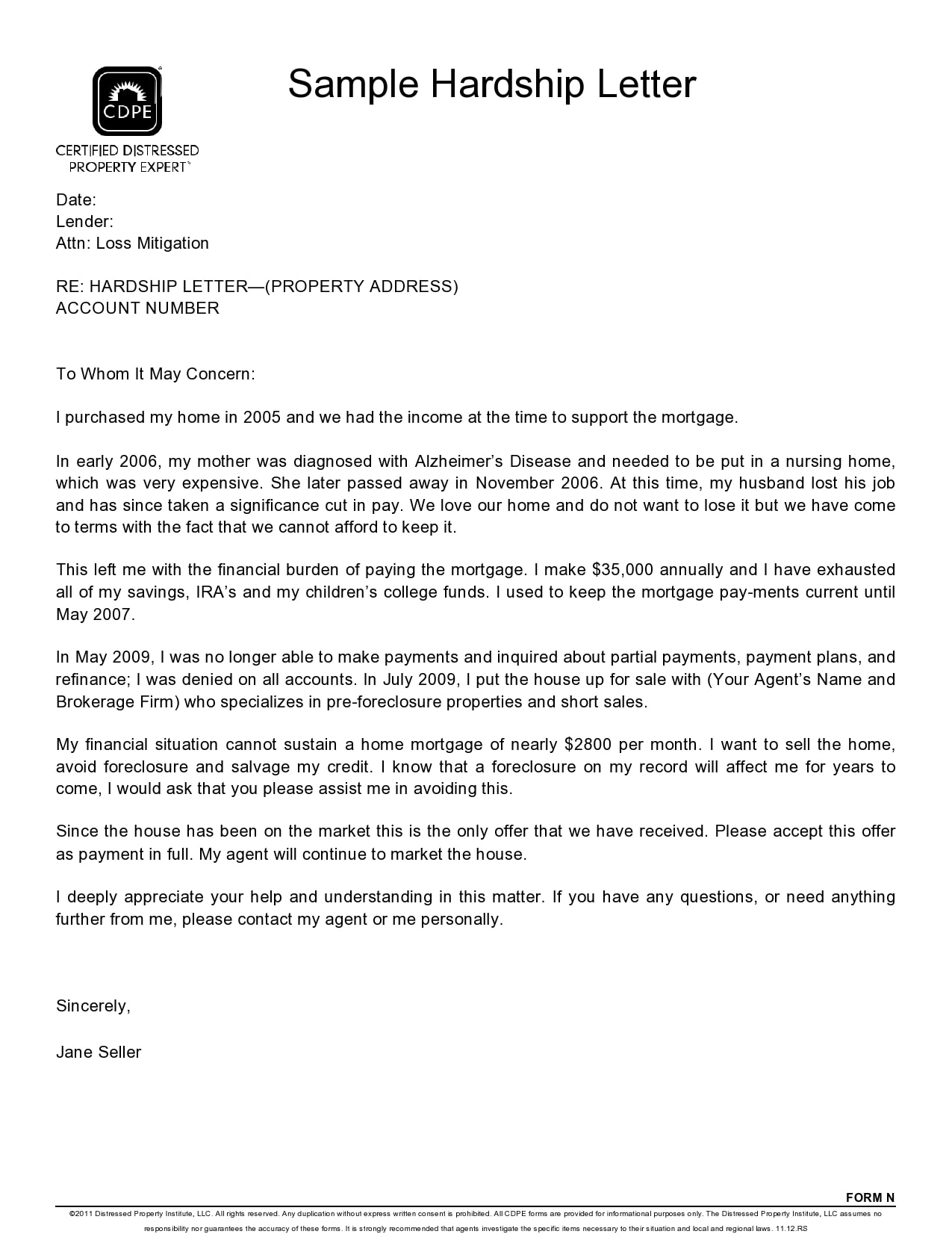

A short sale of your. Homeowner name (s), address (s), and phone number (s). Keep your hardship letter brief and to the point:

Illustrate the severity of your hardship. Start by writing a brief introduction. This financial hardship letter is for use by a.

With an understanding of your circumstances and. A feeling of gratitude, admiration, or acknowledgment. The letter could suggest:

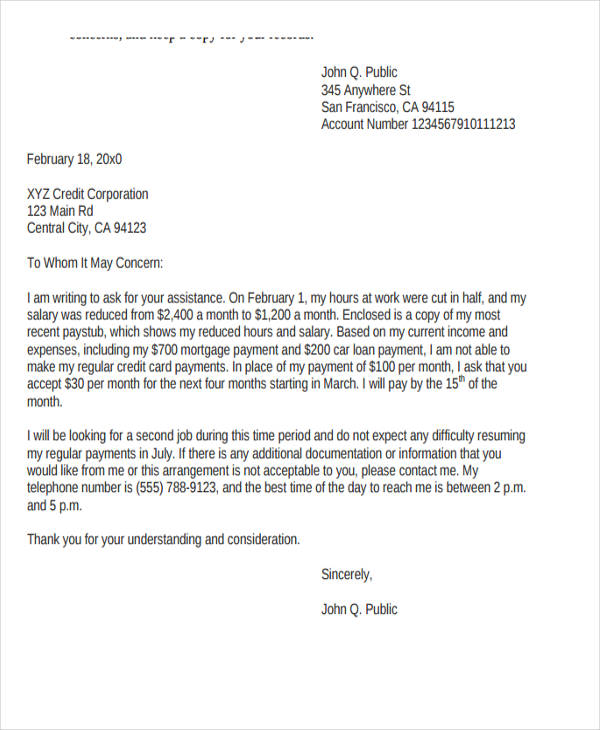

(your email address) phone number: The best guidance is to stick with the facts, be honest, and stay focused on the financial problem. How to get through financial hardship.

Digressing into emotional issues, detailed health issues, and problems at work only confuse the issue and does not help your case. Demonstrate your efforts to remedy the. Writing a hardship letter to one or more of your creditors can help you get through a tough financial time.

The date or approximate time frame when the hardship started. (your phone number) to whom it may concern: How to write a hardship letter.

Asking for a lower interest rate. You need to explain your financial situation, and why you can’t. The date, your name, address and phone number.

How to write a financial hardship letter (5 steps) 1. How to write a hardship letter. Prepare a formal letter of request.

If you come to the point that you have to consider a short sale, you will need to write a hardship letter to your lender. There are three basic areas that everyone should address in their hardship letter. If you are applying for a loan modification or a short sale on your home, you will likely need to write a hardship letter.